Private Sector

The private sector is the economy, which is run by individuals and is for profit. Furthermore, it includes all for-profit businesses that are not owned or operated by the government. The private sector comprises all privately owned, for-profit businesses in the market. It makes up a significant size of the share of the economy in the free market and capitalist-based societies.

Private sector businesses can also collaborate with government-run agencies in arrangements called a public-private partnership.

The private sector tends to make a profit and employ more employees than the public sector does. Private sector organizations are created by forming a new enterprise or privatizing a public sector organization. Businesses in the private sector decrease prices for goods and services while competing for consumers’ money, which means customers do not want to pay more when they can buy the same item elsewhere at a lower cost. In most free-market economies, the private sector makes up a significant portion of the economy. Examples of national private sector sizes are as follows: the United States, 89.46%; Canada, 87.72%; Australia, 85.85%; Japan, 84.38; and the United Kingdom, 83.65%.

Types of businesses in the private sector include partnership, sole proprietorship, small and medium business, extensive cooperation, multinationals, and professionals. All companies operating in that country must follow its law.

Public Sector

The public sector is the economy that is government-owned and government-controlled enterprises. It does not include private companies and households. It provides government ownership or control rather than mere function and thereby provides for a public authority or the implementation of public policy. It refers to industries owned or controlled by the government or things related to these businesses and industries.

Examples of public sectors are education, social service, electricity, fire service, healthcare, law enforcement, police, waste management, emergency service, law and order, public transport, etc. The public sector is also used for investigative purposes, particularly in contrast to the private sector and voluntary sector. It allows for the mapping of the scope of state activities within the broader economy. The public sector is funded directly through taxation; the delivery organization generally has no specific requirements to meet commercial success criteria, and the government determines production decisions.

State-owned enterprises, which differ from direct administration, have greater management autonomy and operate according to commercial criteria. A government does not generally make production decisions.

Libertarians have criticized the idea of public sector provision of goods and services as inherently inefficient. Libertarians have also argued that the system by which the public sector is funded, namely taxation is itself coercive and unjust. However, even small-government proponents have pushed back on this point of view, citing the ultimate necessity of a public sector to provide certain services, such as national defenses, general work, and utilities.

Fiscal Policy

Fiscal policy means a government adjusts its spending levels and tax rates to monitor and adjusts its spending levels and tax rates to check the nation’s economy. Fiscal policy is from British economist John Keynes. The government can affect macroeconomic productivity levels and public spending. It curbs inflation between 2-3%, increases employment, and maintains the health value of money. In 2012, many worried that the fiscal cliff—a simultaneous increase in tax cuts, and cuts in government spending—set to occur in 2013 would send the US economy back to recession. The idea is to balance between tax rates and public spending. For example, stimulating a stagnant economy by increasing or lowering taxes is also known as expansionary fiscal policy. An increase in money in the economy, followed by a rise in consumer demand, can decrease cash.

The effect of any fiscal policy depends on financial stability, political orientations, and policymakers. A tax cut could primarily benefit the middle class, which is typically the most important economic group. During an economic recession, it is the same group that may have to pay more taxes.

Monetary Policy

Monetary policy, which is the demand side of economic policy, refers to the actions undertaken by a nation’s central bank to control supply to achieve macroeconomic goals that promote sustainable economic growth. Monetary policy tools include open market operations, direct lending to banks, bank reserve requirements, and emergency lending programs – subject to the central bank’s credibility. Monetary policy consists of drafting, announcing, and implementing the plan of actions taken by the central bank.

During a recession, the monetary authority can opt for an expansionary policy to increase economic growth and expand economic activity. The monetary policy often lowers interest rates through various measures that make money-saving relatively unfavorable and promote spending. It increases the money supply in the market, hoping to boost investment and consumer spending, i.e. COVID Recovery Package.

In contrast, an increased money supply can lead to high inflation or raising the cost of living and doing business. A contractionary business policy can lead to higher inflation or increasing the cost of living and doing business. It increases interest rates, slows the money supply’s growth, and aims to bring down inflation. It can slow economic growth and increase unemployment, however.

Capitalist Economy

A Capitalist Economic system is a free markets economy and less government intervention in the economy. A capitalist economy needs some government intervention, primarily to protect private property.

Economic freedom – individuals can set up a business and provide the goods and services they want.

Consumer sovereignty: Consumers are free to decide which goods and services to purchase.

Limited Government: Government intervention is limited to protecting private property and the provision of public goods.

Profit motive: seen as essential for enabling efficient distribution of resources and encouraging innovation and a responsive market.

Market forces: Goods and services are distributed according to the invisible to the market. In other words, market forces determine the allocation of goods.

Free trade has low tariff barriers to encourage international trade.

Many economies have a capitalistic economic system that may have government spending taking up to 35% GDP as the government pays for welfare, health, education, and national defense. However, the economy is viewed as capitalist because private enterprises can decide what to produce and for whom.

Socialist Economy

Socialists argue shared ownership of resources and central planning offers a more distribution of goods and services. They take that workers who contribute to economic output should expect a commensurate reward.

For example:

-Public ownership of the means of production

-Central planning of the economy

-Emphasis on equality and economic security

-Goal of reducing class distinctions

The concentration of power within the state can make an environment where political motivations override the people’s basic needs. Indeed, at the same time the USSR was diverting vast resources to increase its military capability, its residents often had trouble attaining a variety of goods, including food, soap, and even TV sets.

Mixed Economy

A mixed economy is a combined element of the market and the socialist economy. It is combined with the elements of the market and the command economy.

Individuals in the market make the most economical decisions. However, the government also plays a role in resource allocation and distribution. A mixed economy may increase when a government intervenes to disrupt the free market by introducing state-owned enterprises, regulations, taxes, subsidies, etc.

Mixed economies have public, private, legislative, judicial, and regulatory components. There is not a single deal, and the mix may vary. Elements in the blend may include government subsidies, fees, taxes, set-aside programs and regulations, state-owned enterprises, social security, or national health programs.

It is an economic principle that when supply exceeds demand for a good or service, prices fall. Suppose that demand exceeds supply, prices increases. There is an inverse relationship between the supply as well as expenses when the market remains the same. If there is a rise in supply for goods and services when demand remains the same, prices fall to a lower equilibrium price and a higher equilibrium quantity of goods and services.

The inverse relationship holds for the demand for goods and services. However, when demand increases and supply remains the same, the higher demand leads to a higher equilibrium.

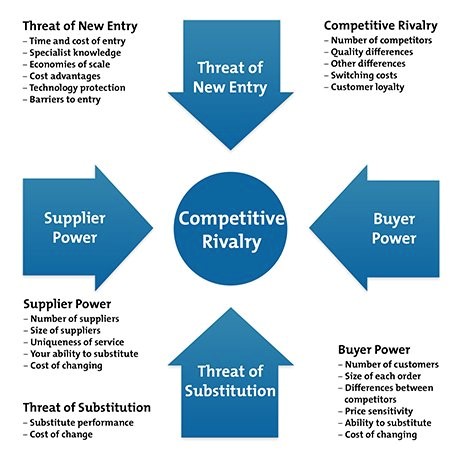

Figure 1 – Porter’s Five Forces

Porter’s Five Forces is a business model that explains why various industries can sustain different profitability levels.

The threat of entry refers to when new entrants to an industry bring new capacity, the desire to gain market share, and often substantial resources. The seriousness of the entry risk depends on the barriers present and reactions from existing competitors that entrants can expect. If impediments to high and newcomers can expect sharp retaliation from the entrenched competitors, the newcomers will not pose a severe threat of entering.

Buyer power pertains to how buyers drive prices down. It is strongly influenced by the number of buyers in the market, the importance of each buyer to the organization, and the cost of moving from one supplier to another to the consumer.

Supplier power explains how suppliers drive prices up. It is caused by the number of suppliers of every essential input, the uniqueness of their products or services, and their relative size and strength, and the cost of switching from one supplier to another.

Competitive rivalry: The main driver is the capability of competitors in the market. Many competitors offering undifferentiated products and services reduce market attractiveness.

The threat of substitution is where close substitute products exist in the market. It raises the likelihood of customers switching to alternatives in response to price increases. It reduces both the power of suppliers and the attractiveness of the market.

Effect of market decisions and their influences on business policies

Goals

As with all functional areas, business goals are an essential internal impact. Marketing objectives should not conflict with business goals.

Business Culture

A marketing-oriented business is continuously looking for ways to meet customer needs. The culture of production-oriented culture changed by the recession. Exchange rates and other factors will also affect international marketing-related goals.

Financial

Business financial conditions will directly impact the scope and size of marketing activities.

Market Dynamic

The primary market dynamics are market size, growth, and segmentation. Any of these changes will undoubtedly affect the market objectively. The slowdown in the market is unlikely to support the enormous revenue growth or new product development goals.

Building various cultures on business – 10 Elements of the great company culture of BERYL

- Core Values – It is an essential guide point when developed, communicated, and executed consistently. Behaviors will not change, no matter how the company changes.

- Camaraderie – It is about getting to know colleagues. Many companies host annual traditions like family day, the fall festival, and family parties or publish company magazines. For example, Beryl publishes a bi-monthly full-color magazine sent to the homes of workers.

- Celebrations – At Beryl, they developed the PRIDE program (Peer Recognizing, Individual Deed of Excellence). It allows co-workers to recognize others for living up to Beryl’s core values.

- Community – They have dedicated countless hours to community service in Bedford, Texas, to help those in need. This not only helps the organization’s support but also brings great pride to a staffer.

- Communication – Some companies hold quarterly Town Hall meetings, which include several sessions over a number of days. Some send a monthly personal letter to the staff with pictures of family and set up an internal website for anyone that has a question not easy to share in a group.

- Caring – A company should show that it genuinely cares about its employees in the totality of their lives. Any manager can explain a situation on an internal website that identifies a co-worker and lists what is going on.

- Commitment to Learning – This is when a company shows its employees it is committed to their professional growth.

- Consistency – Culture is based on tradition. If an employee creates excellent programs or events, make them regular events, and do them consistently.

- Connect – A company should connect with people at all levels of the company.

Global factors affecting business

P.E.S.T.

Political – Regime change through coup, violence, etc., change in government through democratic election can influence future business strategy, i.e., US Presidential Election 2020.

Political Uncertainty – Example countries with political uncertainty are Zimbabwe, Sudan, and Venezuela. Political uncertainty can lead to a drop in investment and influence decision-making.

Social

Religious consideration – This concerns appropriateness of some business ventures, e.g., selling condoms in catholic countries.

Impact on local communities of business development – availability of jobs, training, environmental impact for communities

Technological – availability and developments in technology can have a powerful influence on global business strategy, i.e., broadband, PC ownership, technology, and sales (processing payments and sales).

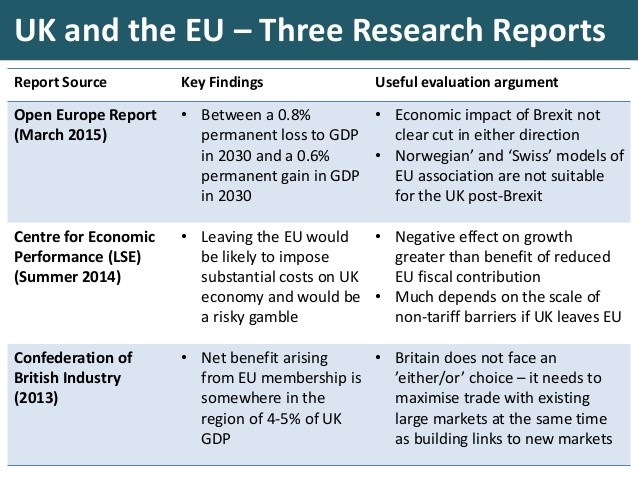

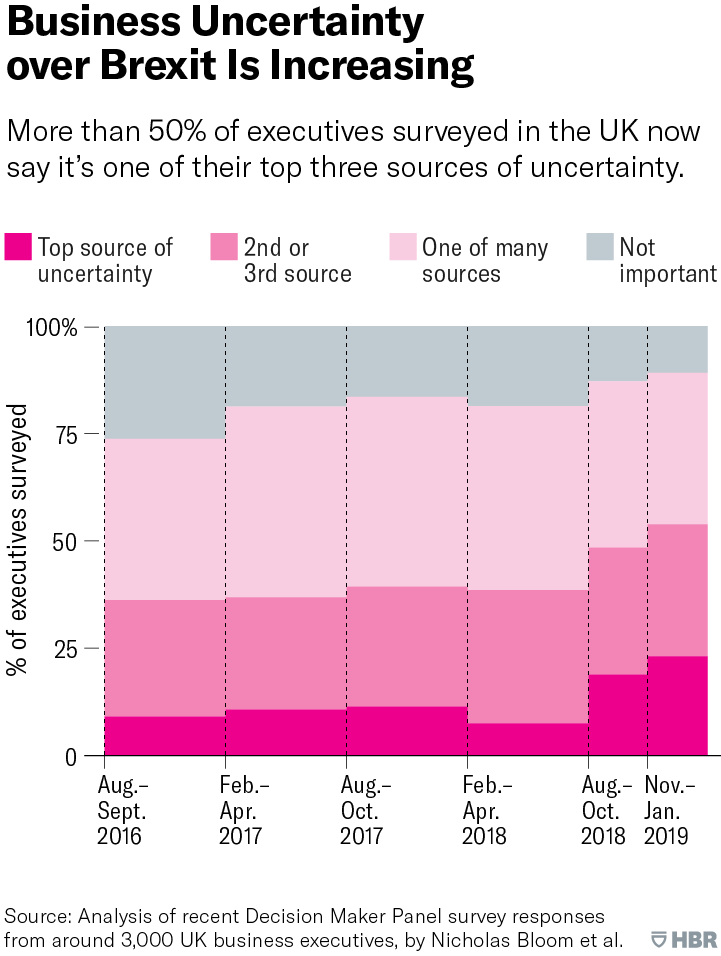

A diagram explaining the impact of EU policies on UK business

This chart indicates the effect that companies expect BREXIT to have on their exports, sales, and costs; on average, businesses anticipated BREXIT to reduce their revenue by around 3%. The exports were expected to be negative, while unit cost and financing costs were expected to increase. UK companies export more goods and services to the European Union, import more materials from the EU, and employ more labor from the EU. International companies were the most uncertain and expected BREXIT to have more adverse effects on their sales. These internationally exposed firms also tend to be more productive than average. More productive firms expect the eventual impact of BREXIT on deals to be more damaging than less effective firms.

Suppose BREXIT reduces the output of highly productive firms by more than low productivity by batting an average type effect. It estimates that this reallocation effect could eventually lower the level of UK productivity by 0.5%. Given that the UK economy has had low productivity growth in the last decade, this effect is worth around a year of productivity growth.

Reference

Britannica, 2020. Public sector (Online) Available at: (britannica.com) Assessed 25th September 2020.

Chappelow, J., 2020. What is Private sector? (Online) Available at: (www.investopedia.com) Assessed 28th September 2020

Chappelow, J., 2020. What is Monetary Policy? (Online) Available at: (www.investopedia.com) Assessed 28th September 2020

Giles, C., 2020. What has the EU done for the UK? (Online) Available at (www.ft.com) Assessed 28th September 2020

Helping to simplify economics, 2020. Capitalist Economic System. (online) Available at: (www.economicshelp.org) Assessed 28th September 2020.

Kramer, L., 2019. How down the law of supply and demand affect prices?. (Online) Available at: (www.investopedia.com) Assessed 28th September 2020.

Kramer, L., 2019. What is fiscal Policy? (Online) Available at: (www.investopedia.com) Assessed 28th September 2020.

Kurt, D., 2018. What exactly is a socialist economy? (Online) Available at: (investopedia.com) Assessed 28th September 2020.

Mindtools, 2020, Porter’s Five Forces (Online) Available at: (www.mindtools.com) Assessed 29th September 2020

Spiegelman, P., 2020. Elements of Great Company Culture. (Online) Available at: (inc.com) Assessed 27th September 2020